The recent uptick in the price of oil casts a shadow over South Africa’s positive inflation trajectory. Transport helped pull overall inflation down in July, in contrast to 2021 and 2022 when overall inflation was mainly pushed higher by transport and headline consumer inflation hit a 13-year high of 7.8% in July 2022, with transport contributing 44% (3.4%) to the headline rate, according to Stats SA figures.

Fast forward a few months, and the oil price is close to $90 a barrel after briefly flirting with $95 a barrel a few weeks ago.

Oil price (six months):

Source: Trading Economics (16 October 2023)

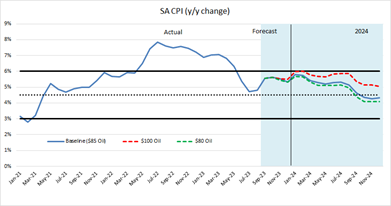

Based on an assumption that the oil price hovers around $85 dollars a barrel for the remainder of 2023 and 2024, Amplify SCI* Strategic Income fund portfolio managers expect inflation to return to target by the end of 2024, despite remaining somewhat elevated in the near term, as depicted in the graph below. In their view, this does not necessarily imply that we will only start seeing rate cuts at the end of 2024. Based on the baseline forecasts, how long ago the South African Reserve Bank (SARB) started raising rates (November 2021), where the stance of monetary policy currently is (restrictive with the real repo rate at 3% vs the neutral stance at 2.5%) and its acknowledgement that tighter policy is showing up in slowing credit extension and households feeling the pinch, we think the SARB has put up a good fight to defend its inflation-fighting credentials.

CPI (% change):

Source: Terebinth Capital(16 October)

The inflation trajectory depicted in the above graph appears supportive of a first cut in Q2 2024, but other noise in the system, such as a higher for longer developed market central bank stance and South African fiscal issues, will likely mean the cutting cycle is shallow rather than meaningful.

The major risks are:

- Oil prices: The potential for oil prices to surge beyond expectation remains a substantial risk, with some forecasts, including those of Goldman Sachs, suggesting a potential ascent to $100 a barrel. Should this view play out, inflation in South Africa will not hit the mid-point of the target range by the end of 2024, causing rates to stay higher for longer.

- El Niño: Stronger El Niño conditions were highlighted by the Monetary Policy Committee as a threat to the agricultural outlook and consequently food inflation.

- Exchange rate: The exchange rate’s fluctuation, particularly the weakening rand against the dollar, directly impacts fuel prices and has secondary effects on food inflation as transport costs increase. In addition, the price of importing goods increases, creating an inflationary ripple effect.

Over the last 15 years, the oil price has had a strong inverse relationship to the USD/ZAR exchange with a correlation of -0.7. Intuitively, this makes sense, as higher demand for oil is usually associated with stronger global growth expectations, laying the foundation for a risk on environment which is favourable for the rand. As we import oil, the inverse relationship between the oil price and the USD exchange rate have opposing effects on inflation. If the inverse relationship breaks down, the increasing ZAR oil price has a growing impact on headline CPI.

Another risk highlighted by the portfolio manager of the Amplify SCI* Wealth Protector Fund is the state of our fiscus. For the last decade, South Africa has run growing budget deficits while growing at levels which can’t sustain them. As a result, we have a deteriorating balance sheet, with debt/GDP expected to remain above 70% for the foreseeable future. The weakened balance sheet, in a higher rate environment, compounds the risk premium associated with South Africa. As such, the rand is predicted to weaken unless these dynamics slow, and there is an increasing probability that the inverse relationship between oil and the US dollar breaks down or weakens, which would result in inflationary pressure structurally in the future.

It is difficult to argue with the SARB’s finding that serious upside risks to the inflation outlook remain. Consequently, it may be unrealistic to expect substantial rate cuts in 2024.

https://www.amplify.co.za/unit-trusts-disclaimer