Click here to watch webinar on demand

Amplify Investment Partners has launched two new retail investor hedge funds to expand its fast-growing unit trust and hedge fund options – the Amplify SCI Property Retail Hedge Fund and the Amplify SCI Active Equity Retail Hedge Fund.

The two new funds exemplify Amplify’s commitment to finding unique investment opportunities, which have resulted in it continuing to perform strongly and growing assets under management to R62bn from R46.7bn at end-2023, Wade Witbooi, head of Amplify, says.

The Amplify SCI Property Retail Hedge Fund is run by Catalyst Fund Managers, a boutique manager focused solely on listed local and global property with R27bn under management and over R1bn in alternative listed real estate in its SA hedge fund, global hedge fund and now the Amplify SCI Property Retail Hedge Fund.

The new fund is a long, short variable-bias hedge fund invested in local and global listed real estate. It selects assets using a discounted cash flow method for earnings with an adjusted bond hurdle rate to generate a relative value. It overlays special opportunities such as discounted vendor placements, corporate events, derivatives, and macro-opportunities.

Director and portfolio manager Marcus Erlank says the fund’s risk-adjusted returns evaluation focuses on the risk and return potential of company earnings, real estate portfolio quality, capital structure and quality of management. It chooses stocks for both long and short positions and looks for opportunities in different geographies. It aims for a 12% to 15% annualised return over a 3-5 year period and uncorrelated income stream through the cycle.

The fund takes advantage of the attractive risk-adjusted return characteristics of listed real estate, which is a poorly understood, under-researched and underappreciated asset class, providing arbitrage and mispricing opportunities. It finds opportunities in independent long and short pair trades with large positive and large negative risk-adjusted relative valuation opportunities and exploits a low correlation between local and global listed real estate.

Event-driven and opportunistic trades include discounted vendor placements, merger/takeover arbitrage, corporate activity opportunities like IPOs, secondary offerings, placements, right offers and scrip dividends.

While exposure varies during the cycle, the fund generally invests one third in local listed property (including A units), one third in global listed property (including JSE listed rand hedge stocks, investment into the Catalyst Global Hedge Fund and direct offshore stocks) and one third cash and cash equivalents (working capital and enhanced cash through money market or strategic income funds). There is a relentless focus on protecting the downside.

Since inception in 2006, its local hedge fund investment of R100 is worth R1711.39 against a benchmark FTSE/JSE All Property Index (ALPI) of R366.74 and benchmark three-month JIBAR** of R554.42. It has returned 16.04% annualised against the ALPI’s 9.39% and benchmark 7.05%. The fund returned 12.62% over five years – delivering 5% alpha with half the volatility.

Erlank highlights the team’s abilities in SA, where there are 25 to 30 opportunities, and offshore, where they look at 120 to 150 stocks. While the SA counters are fairly diversified in retail, industrial and offices, offshore stocks provide regional and subsector long short opportunities to extract alpha, for example in subsectors like student housing, cold storage, towers and data centres.

“We have a single asset class focus and we stay in our lane, with an experienced team and proven track record exceeding hurdle, ALBI and JSE listed with lower volatility”, Erlank says.

SA listed property is fairly valued after a good run last year off a low base, but with low downside risk to earnings. Global property is at the cheaper side of fair value, so the fund has increased its weighting somewhat.

With possible trade wars, real estate provides safety with long contractual leases and will do well in a lower-growth environment.

The Amplify SCI Active Equity Retail Hedge Fund is managed by AG Capital, a hedge fund manager involved in active solutions. The new fund invests in SA equities with a long bias and it focuses on the top 40 companies. It has a momentum-driven strategy with a fundamental overlay seeking absolute returns regardless of market direction.

The moderate-aggressive long short equity hedge strategy aims to reduce the volatility of returns, with a core focus on capital preservation and risk management. It avoids overcrowded trades as these typically present limited upside potential, and its strategy is not dependent on market direction to generate returns, according to portfolio manager Richard Arnesen.

In terms of process, the team establishes an underlying macro thesis, and does fundamental analysis into company earnings, growth and positioning in the current environment and considers money flow. The investment team drives idea generation, looking at exposing the fund to the highest conviction ideas, creating a concentrated portfolio of 15 to 20 positions for tighter risk management and control. A wide mandate with an extensive toolbox assists in risk management.

A crucial step is its review of the portfolio and a focus on capital preservation, minimising drawdowns and trying to deliver consistent returns.

AG Capital’s Rainbow RHF, which shares the same team, strategy and process as the Amplify SCI Active Equity RHF, recorded an annualised five-year return of 18.81% against the ALSI’s 13.06%, with the largest cumulative drawdown being 6.52% against the ALSI’s 21.38%.

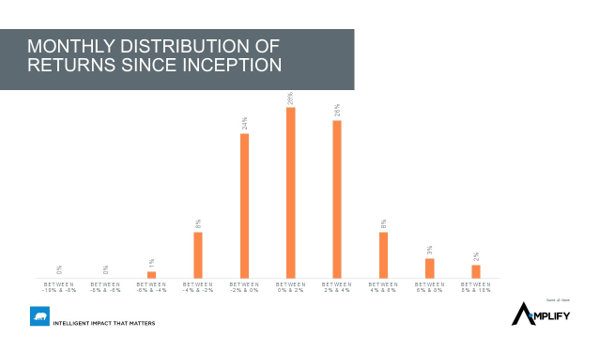

The monthly distributions of returns since inception of the strategy highlights the effectiveness of the risk management of the fund as shown by the positively skewed distribution of returns.

* Johannesburg Interbank Average Rate

Click here to view disclaimer